Dollar Tree, a Fortune 500 company operating over 15,000 stores and 24 distribution centers, offers a competitive 401(k) retirement savings plan for its employees. This plan is designed to help associates secure their financial future while benefiting from tax advantages and company contributions.

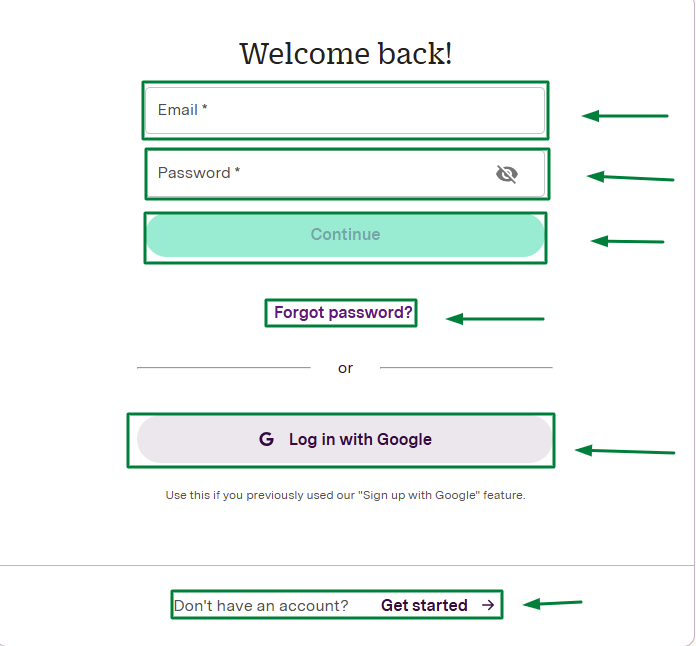

Login to Dollar Tree 401(k) Plan

Accessing your Dollar Tree 401(k) Plan is simple and secure. Click the button below to log in and manage your retirement savings.

Login Credentials

Enter the following details to log in:

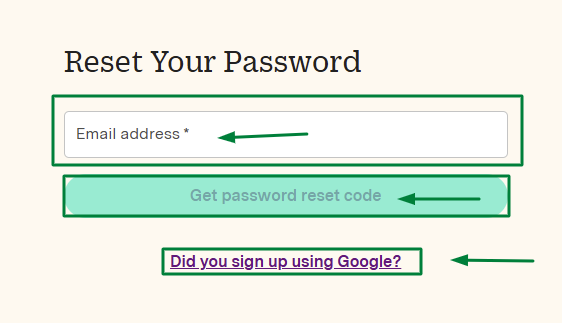

Forgot Password?

You can click on Forgot Password? to reset your credentials if needed.

Login with Google

If you previously signed up using Google, click below to log in effortlessly:

[Login with Google]

Don’t Have an Account?

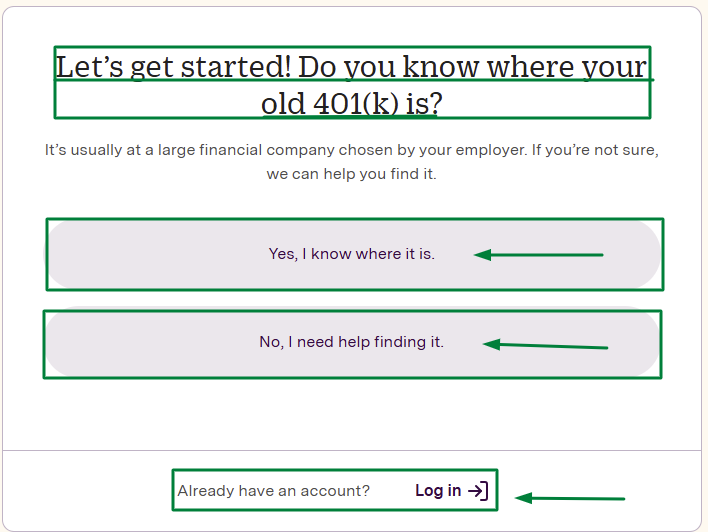

Locate Your 401(k) Plan

Not sure where your old 401(k) plan is? We can help!

Managing your 401(k) has never been easier. Create an account or login today to secure your financial future!

Eligibility for the Dollar Tree 401(k) Plan

To participate in the Dollar Tree 401(k) plan, you must meet the following criteria:

Key Features of the Dollar Tree 401(k) Plan

Contributions

Company Match

Tax Advantages

Vesting Schedule

Dollar Tree uses a staggered vesting system, which determines when the company’s matching contributions become fully yours:

This structure rewards long-term employees and encourages retention.

Accessing Your 401(k) Funds

Withdrawals Before Age 59½

Withdrawals After Age 59½

Rollovers

Conclusion

The Dollar Tree 401(k) plan is a valuable benefit that provides employees with a robust retirement savings tool. With features like a company match, tax advantages, and diverse investment options, it’s a smart way to prepare for the future.

By participating in this plan, you can take control of your financial health and enjoy peace of mind knowing you’re building a secure retirement. Take advantage of this opportunity and start planning for your future today!